Al Rajhi Bank Loan Procedure

The representative will check the legal case and communicate with lenders on your behalf.

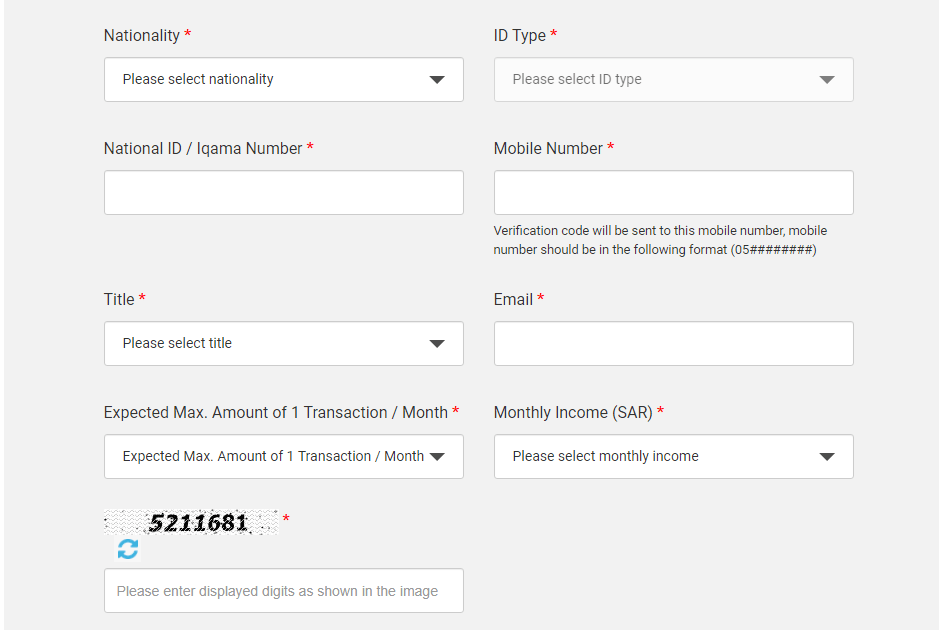

Al rajhi bank loan procedure. What are the purchase procedures and requirements that follow. Al rajhi bank chairman of the board of directors mr. To begin simply visit your nearest branch. Please be aware that there exists a cloned and copied al rajhi bank website as well as emails created for the purpose of deceiving unwary customers and members of the public.

Registering the car in the customer s name and mortgaging it for the bank. In order to pay the unpaid personal loan debt credit card from al rajhi bank or any other bank in saudi arabia after the final exit you should have a legal representative or lawyer in the kingdom. Up to jod 50 000 or 30 times the net salary for public sector and 25 times the net salary for private sector. Bank accounts car loans schools.

Watani is al rajhi bank s flagship personal finance solution that responds to your short and long term needs at the pace that you desire. We understand that you may still be affected by the pandemic and al rajhi bank will continue to support you during this challenging time. All of al rajhi bank s products are sharia compliant. For new cars financing up to 90 of the car s value and up to jod 60 000 for the target market list.

Request a callback online and receive a callback within 24 hours. An increase of 2 3. This fake site and emails have absolutely no affiliation with al rajhi bank whatsoever and have been created with malevolent and impure intentions. For used cars financing up to 80 of the car s value and up to jod 50 000 for the target market list.

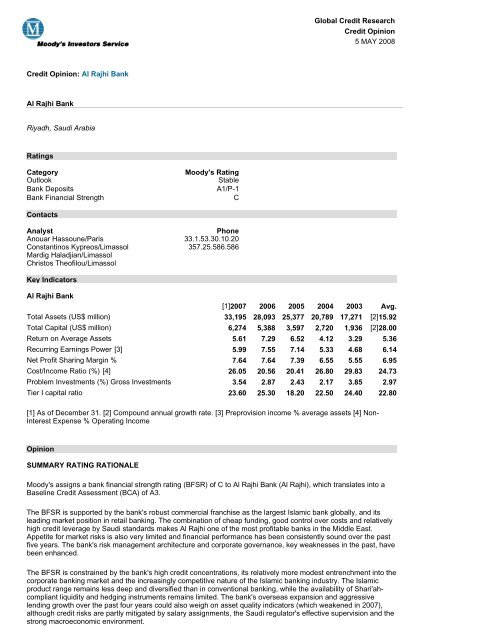

Can i receive the car from the dealer. Abdullah bin sulaiman al rajhi announced that the bank made profits before zakat in the second quarter of the year 2020 that have reached 2 716 million riyals as opposed to this year s first quarter which amounted to 2 654 million riyals i e. Covid 19 financial relief assistance bantuan pelepasan kewangan covid 19 the 6 month moratorium will end on 30 september 2020. Thanks to a seamless end to end process you can avail a fully sharia compliant personal financing in only 30 minutes.