How To Calculate Basic Salary In Saudi Arabia

If a worker s basic salary is sr 2500 and he has worked 50 extra hours in a month overtime wages will be as follows.

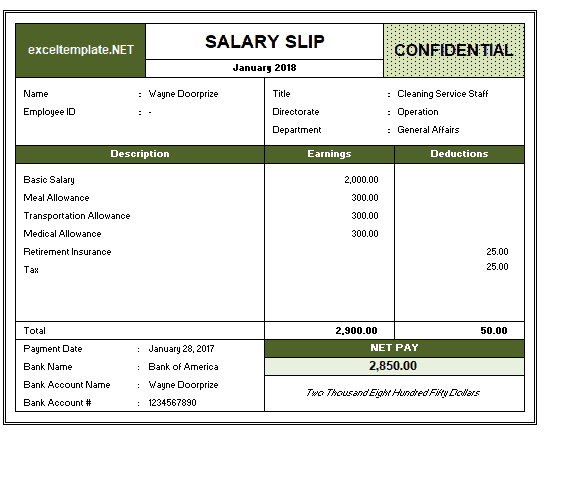

How to calculate basic salary in saudi arabia. The employer is responsible to pay 2 of expat employees salary basic housing as gosi contribution. 10 41 x 1 5 15 61. Full salary after the first 5 years for each year served. 1 2 salary for the first 5 years for each year served.

Your average tax rate is 10 00 and your marginal tax rate is 10 00 this marginal tax rate means that your immediate additional income will be taxed at this rate. Gosi calculation for expats. Select advanced and enter your age to alter age related tax allowances and deductions for your. Sr0000 30 x 1 75 x 24 sr 0000 00 according to dark hollywood the computation above is for two 2 years of service only which is equivalent to 24 months.

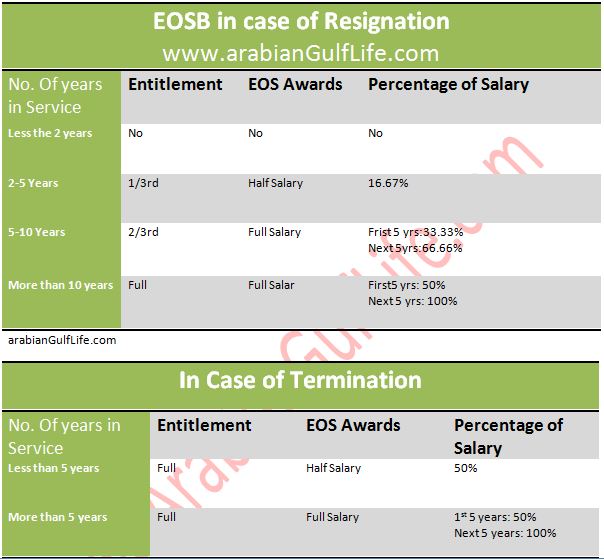

Basic salary divided by thirty days multiply by 1 75 21 days 12 months 1 75 multiply by 24 months. As per article 84 of saudi labor law an employee is entitled to the following end of service benefits in case of termination. Basic salary x 1 2 x 1 3 in between 5 to 10 years of employment the employee will get an esb equivalent to 2 3 of his her full salary basic salary x 2 3. Calculate your end of service benefit esb in saudi arabia.

Hourly wage 200 8 25 sr. There is no gosi fee to be paid by the expatriate in saudi arabia. Annual basic salary monthly basic salary x 12. The gosi contribution is always calculated on the basic salary housing allowance.

Enter your salary and the saudi arabia salary calculator will automatically produce a salary after tax illustration for you simple. This means that the average person in saudi arabia earns approximately 96 sar for every worked hour. Gosi calculation for saudis employer s contribution. Daily wage monthly basic salary 30.

The lowest paid saudi arabia are it software development professionals at 32 000. The highest paid saudi arabia are legal paralegal professionals at 320 000 annually. In saudi arabia if you resigned or get terminated from your work. Keep in mind that there is no esb entitlement if an employee is terminated under article 80 of saudi labor.

Daily wage 6000 30 200 sr. If you make 140 000 a year living in saudi arabia you will be taxed 14 000 that means that your net pay will be 126 000 per year or 10 500 per month. Here is a simple calculation of overtime in saudi arabia. Calculate overtime as per saudi labor law.

Keep in mind that the first 1 3 of the amount will. Example for overtime calculation. If monthly basic salary is 6000 sr.