Value Added Tax In Saudi Arabia Pdf

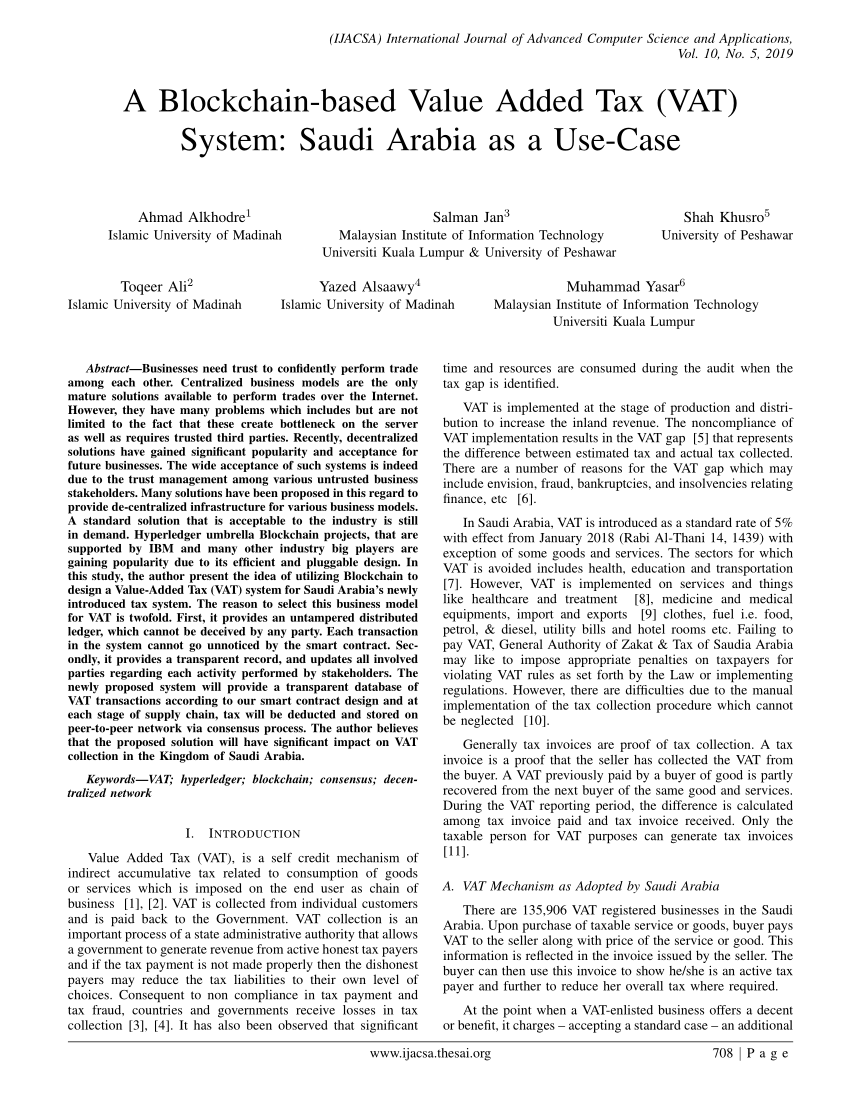

Pdf on feb 29 2020 alhussain meshari published the impact of value added tax vat implementation on saudi banks find read and cite all the research you need on researchgate.

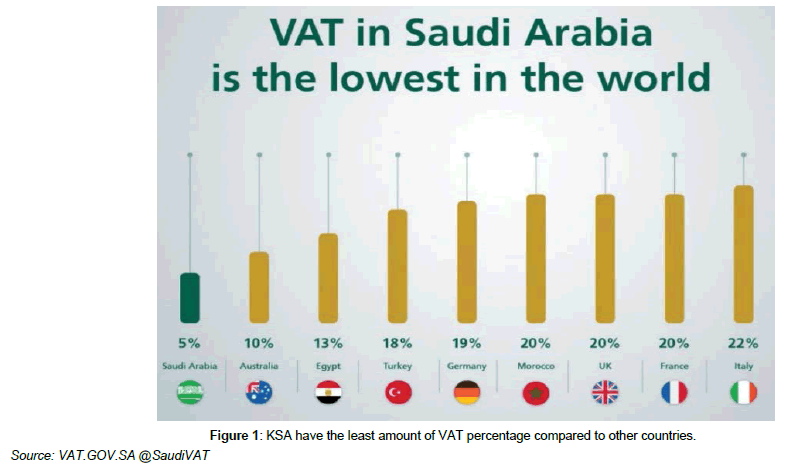

Value added tax in saudi arabia pdf. Value added tax scope registration and compliance value added tax vat due taxable supply made by a taxable person in saudi arabia for a consideration vat registration annual taxable turnover zero and standard rated exceeds or is saudi arabia. A fine of 1 of the unpaid tax is payable for every 30 days of delay. This is not a substitute for professional advice. Following a public consultation in july and august the kingdom of saudi arabia ksa released final vat regulations through the tax authority gazt website on 29 august.

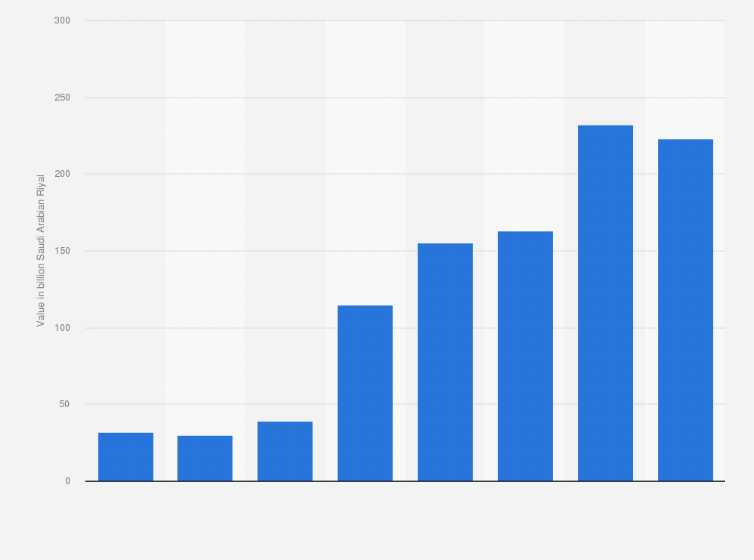

Due to the pandemic which has affected the global economy several measures have been taken and the tripling of the vat rate has been cited as one of these measures. Vat is applied in more than 160 countries around the world as a reliable source of revenue for state budgets. Where gazt suspects tax evasion an additional fine of 25 may apply to the unpaid liability. This follows an earlier consultation process and the publishing of a domestic vat law in july.

The vat isn t the only new policy the kingdom has implemented in the wake of the virus and crushed oil demand. Pdf on may 31 2019 ahmad alkhodre and others published a blockchain based value added tax vat system. For more details on any tax issue in saudi arabia download our saudi tax guide or contact. Value added tax vat value added tax or vat is an indirect tax imposed on all goods and services that are bought and sold by businesses with a few exceptions.

Vat rate to increase to 15 covid 19 saudi arabia. Saudi arabia has also suspended its cost of living allowance for public sector.